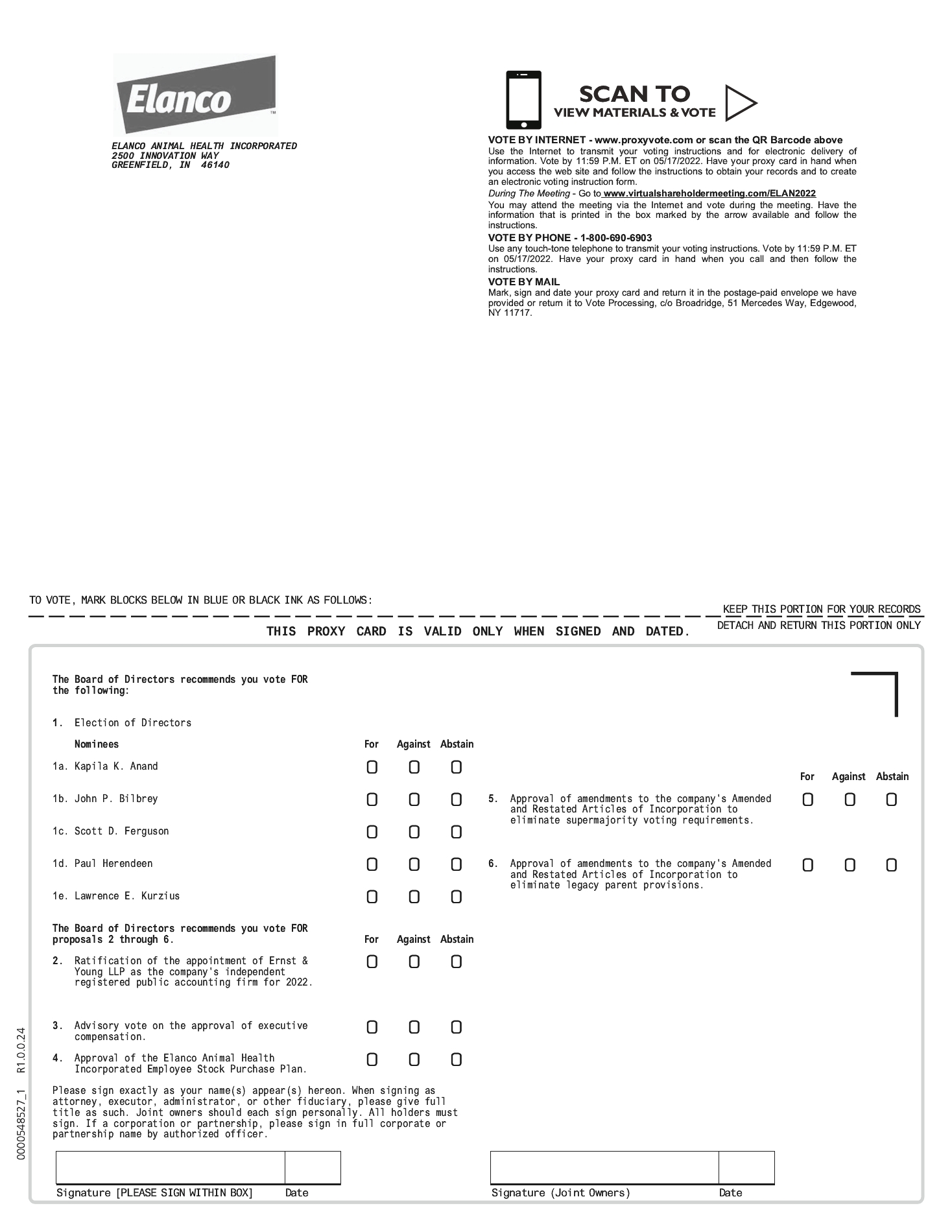

The following table shows

the fees incurred for services rendered on a worldwide basis by EY for 2020 and 2019.| | 2020 | 2019 |

| Audit Fees(1) | $10,364,354 | $6,219,510 |

| Audit-Related Fees(2) | $397,218 | $165,294 |

| Tax Fees(3) | $21,407 | $119,668 |

| All Other Fees | - | - |

| Total Fees | $10,782,979 | $6,504,472 |

| (1) | Includes annual audit of consolidated and subsidiary financial statements, reviews of quarterly financial statements and other services normally provided by the auditor in connection with statutory and regulatory filings and audit procedures related to the Bayer Animal Health acquisition. |

| (2) | Primarily related to services related to employee benefit plan, audit or attestation services required by statutes or regulations and certain other services. |

| (3) | Primarily related to tax compliance services. |

ELANCO ANIMAL HEALTH INCORPORATED – Proxy Statement | 44 |

PROXY ITEM NO. 3: NON-BINDING VOTE ON THE COMPENSATION OF NAMED EXECUTIVE OFFICERS

Section 14A of the Exchange Act requires that we include in this proxy statement a non-binding vote on the compensation of the named executive officersinformation, as described in this proxy statement.

We encourage shareholders to review the Compensation Discussion and Analysis, or “CD&A,” beginning on page 24. The CD&A provides additional details of our executive compensation program, including our compensation philosophy and objectives, the individual elements of our executive compensation program, and how our executive compensation program is administered.

The Board believes that the executive compensation as disclosed in the CD&A, tabular disclosures, and other narrative executive compensation disclosures in this proxy statement aligns with our compensation philosophy and objectives as well as the pay practices of our peer group. The Board strongly endorses the company’s executive compensation program and recommends that shareholders vote to approve the compensation of the named executive officers, as disclosed in this proxy statement, including the Compensation Discussion and Analysis section and the tabular and narrative disclosures included herein.

Although the vote is advisory and non-binding, the Board values the opinions of the company’s shareholders as expressed through their votes and other communications. The Board and the Compensation Committee will consider the outcome of the advisory vote on executive compensation when making future compensation decisions. We currently intend to hold a non-binding shareholder vote on our executive compensation each year at the annual meeting of our shareholders.

Recommendation of the Board

The Board unanimously recommends a vote FOR the approval of the compensation of the company’s named executive officers.

|

ELANCO ANIMAL HEALTH INCORPORATED – Proxy Statement | 45 |

PROXY ITEM NO. 4: APPROVAL OF THE AMENDED AND RESTATED 2018 ELANCO STOCK PLAN, INCLUDING AN AMENDMENT TO INCREASE THE NUMBER OF SHARES AUTHORIZED FOR ISSUANCE THEREUNDER BY 9,000,000.

Introduction

At the 2021 Annual Meeting, our shareholders will be asked to vote to approve the Amended and Restated 2018 Elanco Stock Plan (the “Amended 2018 Plan”), which includes an amendment to increase the number of shares authorized under the current 2018 Elanco Stock Plan by 9,000,000 shares. The Amended 2018 Plan was adopted by our Board of Directors on March 4, 2021, subject to approval by our shareholders.

The Amended 2018 Plan is an important part of the company’s overall global compensation program. It allows the company to make annual and long-term incentive awards to the company’s current and prospective officers, employees, and directors. The purpose of the Amended 2018 Plan is to give the company a competitive advantage in attracting, retaining and motivating officers, employees, and directors with a stock and incentive plan providing incentives that are directly linked to shareholder value in what is now a larger organization with the recently completed acquisition of Bayer Animal Health.

Key Changes

If approved, the Amended 2018 Plan would make the following material changes:

| · | Increase the shares authorized for issuance under the Amended 2018 Plan by 9,000,000 shares; and |

| · | Modify the share provisions to eliminate share recycling for options as well as full value awards (referred to as PAs and RSUs): |

| o | Any shares withheld to cover exercise price or income tax liability upon exercise will not be eligible for being reissued from the Amended 2018 Plan; and |

| o | Any shares withheld to cover for income tax liability upon vesting will not be eligible for reissuance from the Amended 2018 Plan. |

Promotion of Good Compensation Practices

The Amended 2018 Plan is designed to align the interests of shareholders, directors, officers and employees within Elanco. We believe that the following practices support the delivery of plan that values compliance while maximizing shareholder value as well as competitive employee compensation opportunities:

Elimination of share recycling of awards: Shares underlying awards, including options and Full Value Awards under the Amended 2018 Plan, that are withheld to cover option exercise costs or taxes related to income from option exercises or full value share vesting shall not be eligible for reissuance.

Dividends on unvested equity: The Amended 2018 Plan states that any dividends related to an Award subject to the same vesting conditions and accumulate subject to the same forfeiture restrictions as the underlying Award.

Minimum Vesting Requirements: Awards granted shall not vest before the first anniversary within the Amended 2018 Plan except as defined by a change in capital structure related to a change in control or other similar events.

Share repricing: The Amended 2018 Plan does not permit any option or stock appreciation rights repricing or exchanges for cash or another Award without shareholder approval.

No tax gross-ups: The Amended 2018 Plan prohibits tax gross ups as all employee taxes and other contingent liabilities are the responsibility of the Participant.

Limits on Transfer: Awards under the Amended 2018 Plan may not be pledged, encumbered or hypothecated to or in favor of any party other than Elanco or its affiliates, or shall be subject to any lien, obligation, or liability of such participant to another party other than Elanco or an affiliate thereof.

Clawback/Recovery: Awards under the Amended 2018 Plan are subject to recoupment in accordance with our current clawback policy or any other policy adopted by Elanco, inclusive in the event fraud or as required by applicable laws or governance considerations or in other similar circumstances.

ELANCO ANIMAL HEALTH INCORPORATED – Proxy Statement | 46 |

Proxy Item No. 4

Key Data (as of December 31, 2020):

Total shares underlying outstanding options

| 337,229 |

Weighted average exercise price of outstanding options | $31.61 |

Weighted average remaining contractual life of outstanding options | 7.8 years |

Total shares underlying outstanding unvested RSUs | 2,385,502 |

Total shares currently available for grant | 5,238,345 |

Total shares of common stock outstanding | 471,921,116 |

Based on the company’s historical practice, the Board believes the shares available for grant under the Amended 2018 Plan, after giving effect to the amendment and restatement, will be sufficient to cover awards for approximately 5 years.

On March 23, 2021, the closing stock price of Elanco common stock on NYSE was $28.60.

Summary of Terms of the Amended 2018 Plan:

Elanco previously adopted the 2018 Elanco Stock Plan, which was adopted by the Board on September 5, 2018 and approved by Elanco’s shareholders on September 18, 2018. The Board approved the adoption of the Amended 2018 Plan on March 4, 2021, effective upon its approval by Elanco’s shareholders. The following are the material terms of the Amended 2018 Plan, as proposed to be amended and restated. The following summary is qualified in its entirety by the full text of the Amended 2018 Plan, as proposed to be amended and restated, which has been included as Appendix B to this proxy statement. In addition to the key changes described above, the amendments to the Amended 2018 Plan eliminate references to Lilly that are no longer relevant following our separation from Lilly.

Awards. Under the Amended 2018 Plan, the following awards may be granted: stock options (including "incentive stock options" within the meaning of Section 422 of the Internal Revenue Code), restricted stock, stock appreciation rights, restricted stock units, other share-based awards, and performance-based awards (all such grants are collectively referred to in this summary as "awards").

Shares Reserved. Subject to adjustment in the event of specified capitalization events, the total number ofregarding shares of our common stock that will be authorized and available for issuance pursuant to awards granted under the Amended 2018 Plan will be 20,000,000 as of the date the amended and restated 2018 Elanco Stock Plan is approved by Elanco’s shareholders. Subject to adjustment in the event of specified capitalization events, no more than 13,000,000 shares may be issued pursuant to the exercise of incentive stock options.

Shares Reissuable Under the Amended 2018 Plan. The following shares will be available for reissuance pursuant to the Plan: (i) shares that are not issued as a result of the termination, expiration or lapsing of any award for any reason, and (ii) shares subject to a "full value" award that are not issued because the award is settled in cash.

Shares Not Reissuable Under the Amended 2018 Plan. The following shares will count against the maximum number of shares available for issuance and will not be returned to the Amended 2018 Plan: (i) shares that are repurchased on the open market with the proceeds of the exercise of an option, (ii) shares that are covered by an award under the Amended 2018 Plan that are surrendered in satisfaction of the exercise price, purchase price, or tax obligations upon the exercise of a stock option, and (iii) shares that are covered by an award under the Amended 2018 Plan that are surrendered in satisfaction of the tax obligations upon the vesting or settlement of a full value award (such as restricted stock or restricted stock units).

Shares Not Counted Against Share Reserve Pool Under the Amended 2018 Plan. To the extent permitted by applicable law or any stock exchange rule, shares issued in assumption of, or in substitution for, any outstanding awards of any entity acquired in any form of combination by Elanco or an affiliate will not be counted against shares available for grant pursuant to the Amended 2018 Plan. The payment of a dividend equivalent right in cash in conjunction with any outstanding awards will not be counted against the shares available for issuance under the Amended 2018 Plan.

Eligibility. Awards under the Amended 2018 Plan may be granted to any memberour equity compensation plans. As of the Board of Directors, officer, or other employee of Elanco or any of its affiliates who are determined by the Compensation Committee as eligible to participate in the Plan. Incentive stock options may be granted only to our employees and to employees of any of our subsidiaries meeting the requirements of the Internal Revenue Code (the “Code”). Awardssuch date, other than incentive stock options may be granted to our non-employee directors and to employees of Elanco and any of its affiliates.

Administration. The Amended 2018 Plan will be administered by the Compensation Committee. The Compensation Committee has the sole authority to grant awards and sole and exclusive discretion to interpret and administer the Amended 2018 Plan.

ELANCO ANIMAL HEALTH INCORPORATED – Proxy Statement | 47 |

Proxy Item No. 4

The Compensation Committee determines the eligible individuals who will receive grants and the precise terms of the grants (including accelerations or waivers of any restrictions, and the conditions under which such accelerated vesting or waivers occur). The Compensation Committee has the authority to amend or modify the terms of an outstanding award. To the extent permitted by applicable law, our Board of Directors also may delegate to a committee of one or more members of our Board of Directors or one or more officers of Elanco the authority to grant or amend awards to participants other than employees who are subject to Section 16 of the Securities Exchange Act of 1934, as amended, or officers or directors of Elanco to whom authority to grant or amend awards has been delegated.

Stock Options. The Amended 2018 Plan authorizes the grant of incentive stock options, which are intended to satisfy the requirements of Section 422 of the Code, and non-qualified stock options, which do not satisfy the requirements of Section 422 of the Code. The exercise price of stock options granted under the Amended 2018 Plan may not be less than 100% (or higher in the case of certain incentive stock options) of the fair market value of a share of our common stock on the date of grant. While the shares are traded on an established stock exchange, "fair market value" means, as of any given date, the closing price of a share as quoted on the principal exchange on which the shares are listed for such date, or if no sale occurred on such date, the first trading date immediately prior to such date during which a sale occurred. Subject to the one-year minimum vesting requirement described below, options granted under the Amended 2018 Plan will vest at the rate specified by the Compensation Committee. No stock option will be exercisable for more than ten years after the date it is granted.

Until the shares are issued, no right to vote or receive dividends or dividend equivalents or any other rights as a shareholder will exist with respect to the shares subject to an option, notwithstanding the exercise of an option. If a participant ceases to provide services to Elanco or any affiliate, the participant may exercise his or her option within such period of time as is specified in the award agreement to the extent that the option is vested on the date of termination (but in no event later than the expiration of the term of such option as set forth in the award agreement).

Restricted Stock Awards. An award of restricted stock is a direct grant of common stock, subject to such restrictions on transferability and other restrictions as the Compensation Committee may impose (including, without limitation, limitations on the right to vote the underlying shares or the right to receive dividends with respect to the underlying shares). The restrictions, if any, may be based on, among other conditions, continued service, the attainment of performance conditions, or a combination of both. Subject to the one-year minimum vesting requirement describe below, these restrictions may lapse separately or in combination at such times, pursuant to such circumstances, in such installments, or otherwise, as the Compensation Committee determines at the time of the grant of the award or thereafter. Generally, any shares subject to restrictions are forfeited upon termination of employment. The price, if any, that participants are required to pay for each share of restricted stock will be set by the Compensation Committee and will be paid in a form approved by the Compensation Committee, which may be cash, services rendered or to be rendered to Elanco or an affiliate of Elanco, or in another form of payment. To the extent that any dividends are payable with respect to a restricted stock award, the dividends will be accumulated and subject to any restrictions and risk of forfeiture to which the underlying restricted stock is subject.

Stock Appreciation Rights. Stock appreciation rights, or "SARs," typically provide for payments to the holder based upon increases in the price of our shares from the date the SAR was granted to the date that the right is exercised. The exercise price of a SAR may not be less than the fair market value of a share on the date of grant of the SAR. The Compensation Committee may elect to settle exercised SARs in cash, in shares, or in a combination of cash and shares. Until the shares are issued, no right to vote or receive dividends or any other rights as a shareholder will exist with respect to the shares subject to a SAR, notwithstanding the exercise of the SAR.

Subject to the one-year minimum vesting requirements, the Compensation Committee will generally determine when the SAR will vest and become exercisable. The vesting conditions, if any, may be based on, among other conditions, continued service, the attainment of performance conditions, or a combination of both. The Compensation Committee determines the term of a SAR, but no SAR will be exercisable more than ten years after the date it is granted. Unless otherwise provided in the Amended 2018 Plan or an award agreement, upon termination of a participant's employment, a SAR will generally be subject to the same conditions as apply to stock options. A SAR may be granted as a standalone right or in connection with an option granted under the Amended 2018 Plan.

Restricted Stock Units. Restricted stock units are denominated in unit equivalent of shares and are typically awarded to participants without payment of consideration. Subject to the one-year minimum vesting requirements described below, restricted stock units may be subject to vesting conditions based upon continued service, the attainment of performance-based conditions, or both. Except as otherwise determined by the Compensation Committee at the time of the grant of the award or thereafter, any restricted stock units that are not vested as of the date of the participant's termination of service will be forfeited.

Restricted stock units may be settled in shares, cash or a combination of both. Unlike restricted stock, the stock underlying restricted stock units will not be issued until the restricted stock units have vested. In addition, recipients of restricted stock units generally have no voting or dividend rights until the vesting conditions are satisfied and the underlying shares are issued. On the vesting date (or such later date as determined by the Compensation Committee and set forth in the agreement evidencing the award), the participant will be issued one unrestricted, fully transferable share for each restricted stock unit scheduled to be paid out on such date and not previously forfeited. Alternatively, settlement of a restricted stock unit may be made in cash (in an amount reflecting the fair market value of shares that would have been issued) or any combination of cash and shares, as determined by the Compensation Committee, in its sole discretion. The Compensation Committee may authorize dividend equivalents to be paid on outstanding restricted stock units. If dividend equivalents areequity securities were authorized to be paid, they may be payable in cash or shares, as determined in the discretion of the Compensation Committee, only to the extent the underlying restricted stock unit vests.

ELANCO ANIMAL HEALTH INCORPORATED – Proxy Statement | 48 |

Proxy Item No. 4

Other Share-Based Awards. The Compensation Committee is authorized under the Amended 2018 Plan to make any other award that is not inconsistent with the provisions of the Amended 2018 Plan and that involves or might involve the issuance of shares. Subject to the one-year minimum vesting requirements described below, awards may be subject to vesting based on continued service, the attainment of performance conditions, or a combination of both. The Compensation Committee may elect to settle these awards in cash, in shares, or in a combination of cash and shares. The Compensation Committee may establish the exercise price, if any, of any other share-based awards granted under the Plan, except that the exercise price may not be less than the fair market value of a share on the date of grant for an award that is intended to be exempt from Section 409A of the Code. The Compensation Committee may authorize dividend equivalents to be paid with respect to a share-based award that is a full value award that are payable only to the extent the underlying award vests.

Performance-Based Awards. The Compensation Committee may grant to eligible individuals the right to receive performance-based awards. Performance-based awards vest upon the attainment of performance goals based on business criteria specified in the Amended 2018 Plan over a specified performance period. In determining the amount earned by an eligible individual, the Compensation Committee has the right to adjust or eliminate the amount payable at a given level of performance to take into account additional factors that the Compensation Committee may deem relevant to the assessment of individual or corporate performance for the performance period. The maximum number of shares with respect to which one or more performance-based awards may be granted to any one participant during any calendar year may not exceed 1,500,000 shares.

Minimum Vesting Requirements. No award may vest before the first anniversary of the date of grant, subject to certain accelerated vesting contemplated under the Amended 2018 Plan, with the exception of (i) up to five percent (5%) of the number of shares reserved for issuance under the Amended 2018 Plan, (ii) awards granted in connection with the assumption or substitution of awards as part of a transaction, and (iii) awards that may be settled only in cash.

Non-Employee Directors. Non-employee directors will be eligible to receive all types of awards (except for incentive stock options) under the Amended 2018 Plan. No non-employee director may be granted awards, the grant date fair value of which, when aggregated with cash compensation payable to the director in any calendar year, exceeds $800,000 in any calendar year.

Limits on Transferability of Awards. Except as otherwise provided by the Compensation Committee, no award granted under the Amended 2018 Plan may be assigned, transferred, or otherwise disposed of by a participant other than by will or the laws of descent and distribution.

Change in Control. Unless precluded by any applicable award agreement, if a Change in Control of Elanco occurs, each award outstanding under the Amended 2018 Plan that vests solely on continued service that is not converted, assumed, substituted or replaced by the successor corporation, will vest and become exercisable immediately prior to the Change in Control, and following the Change in Control, the awards will immediately terminate. Awards that vest based on the attainment of performance-based conditions will be subject to the award agreement provision governing the impact of a Change in Control, provided the award agreement may not permit vesting of awards at a rate greater than the actual level of attainment and/or will provide for pro-rated vesting based on any reduction to the performance period resulting from the Change in Control. Where awards are assumed or continued after a Change in Control, the Compensation Committee may provide that the vesting of one or more awards will automatically accelerate upon an involuntary termination of the participant's employment or service within a designated period following the effective date of a change of control. "Change in Control" has a specified meaning that is defined in the Amended 2018 Plan.

Adjustments Upon Changes in Capitalization. In the event of any stock dividend, stock split, combination or exchange of shares, merger, consolidation, or other distribution (other than normal cash dividends) of Elanco's assets to our shareholders, or any other similar event or other change related to a corporate event affecting our shares or the price of our shares other than certain equity restructurings identified in the Amended 2018 Plan, the Compensation Committee has discretion to make appropriate adjustments in the number and type of shares subject to the Amended 2018 Plan, the terms and conditions of any award outstanding under the Amended 2018 Plan, and the grant or exercise price of any such award. In the case of certain equity restructurings as specified in the Amended 2018 Plan, the number and type of securities subject to each outstanding award and the grant or exercise price will be equitably adjusted.

Amendment and Termination of Plan. With the approval of our Board of Directors, at any time and from time to time, the Compensation Committee may terminate, amend or modify the Amended 2018 Plan, except that our board may not, without prior shareholder approval, amend the Amended 2018 Plan in any manner that would require shareholder approval to comply with any applicable laws.

ELANCO ANIMAL HEALTH INCORPORATED – Proxy Statement | 49 |

Proxy Item No. 4

Furthermore, absent approval of our shareholders, no option or SAR may be amended to reduce the exercise price or grant price of the shares subject to such option or SAR and (except as permitted under the provisions of the Amended 2018 Plan dealing with certain capitalization adjustments and change in control) no option or SAR may be cancelled in exchange for the grant of an option or SAR having a lower per share exercise price or for a cash payment or another award at a time when the option or SAR has a per share exercise price that is higher than the fair market value of the shares.

Clawback/Recovery. Awards are subject to recoupment under any "clawback" policy adopted by Elanco providing for the recovery of awards, shares, proceeds, or payments to participants in the event of fraud or as required by applicable laws or governance considerations or in other similar circumstances.

Plan Term. The Amended 2018 Plan will continue in effect until terminated by our Board of Directors, but no incentive stock options may be granted under the Amended 2018 Plan after the tenth anniversary of the date the Amended 2018 Plan was approved by our shareholders. Any awards that are outstanding at the time the Amended 2018 Plan terminates will remain in force according to the terms of the Amended 2018 Plan and the applicable agreement evidencing the award.

Federal Income Tax Consequences of Awards. The following is a summary of U.S. federal income tax consequences of awards under the Amended 2018 Plan, based on current U.S. federal income tax laws. This summary does not constitute legal or tax advice and does not address municipal, state or foreign income tax consequences. Participants of the Amended 2018 Plan are urged to consult their own tax advisors with respect to the particular federal income tax consequences to them of participating in the Amended 2018 Plan, as well as with respect to any applicable municipal, state, or foreign income tax or other tax considerations.

Nonqualified Stock Options. The grant of a nonqualified stock option will not result in taxable income to the holder. The holder will recognize ordinary income at the time of exercise equal to the excess of the fair market value of the shares on the date of exercise over the exercise price and Elanco will be entitled to a corresponding deduction for tax purposes. Gains or losses realized by the holder upon the sale of the shares acquired on exercise will be treated as capital gains or losses.

Incentive Stock Options. The grant of an incentive stock option will not result in taxable income to the holder. The exercise of an incentive stock option will not result in taxable income to the holder if, at the time of exercise, the holder has been employed by Elanco or any of its subsidiaries at all times beginning on the grant date and ending not more than 90 days before the exercise date. However, the excess of the fair market value of the shares on the date of exercise over the exercise price is an adjustment that is included in the calculation of the holder’s alternative minimum tax liability for the year the shares are sold.

If the holder does not sell the shares acquired on exercise of an incentive stock option within 2 years from the grant date and 1 year from the exercise date, then any gain or loss realized on the sales of the shares in excess of the exercise price will be taxed as capital gain or recognized as a capital loss. If these holding requirements are not met, then the holder will generally recognize ordinary income at the time the shares are sold in an amount equal to the lesser of (a) the excess of the fair market value of the shares on the date of exercise over the exercise price, or (b) the excess, if any, of the amount realized on the sale of the shares over the exercise price, and Elanco will be entitled to a corresponding deduction.

Restricted Stock. Unless the holder makes an election to accelerate the recognition of income to the grant date (as described below), the grant of restricted stock will not result in taxable income to the participant. When the restrictions lapse, the holder will recognize ordinary income on the excess of the fair market value of the shares on the vesting date over the amount paid for the shares, if any, and Elanco will be entitled to a corresponding deduction.

If the holder makes an election under Section 83(b) of the Code within 30 days after the grant date, the holder will recognize ordinary income as of the grant date equal to the fair market value of the shares on the grant date over the amount paid, if any, and Elanco will be entitled to a corresponding deduction. Any future appreciation will be taxed as capital gain. However, if the shares are later forfeited, the holder will not be able to recover any taxes paid.

SARs. The grant of a SAR will not result in taxable income to the holder. The holder will recognize ordinary income on the exercise date equal to the aggregate amount of cash received or the fair market value of the shares received and Elanco will be entitled to a corresponding deduction. If the SARs are settled in shares and the holder later sells the shares, then the holder will recognize capital gain or loss on the difference between the sale price and the amount of income recognized at exercise. Whether the capital gain or loss is long-term or short-term depends on how long the shares are held.

Restricted Stock Units. The grant of a restricted stock unit will not result in taxable income to the holder. When the restricted stock unit is settled, the holder will recognize ordinary income equal to the fair market value of the shares received or the cash provided on settlement and Elanco will be entitled to a corresponding deduction. Any future appreciation with respect to shares received in settlement of a restricted stock unit will be taxed as capital gains.

Section 409A. Section 409A of the Code imposes complex rules on nonqualified deferred compensation arrangements, including with respect to compensation deferral elections and the timing of deferred compensation payments. Certain equity awards may be subject to Section 409A of the Code, while others are exempt. If an award is subject to Section 409A of the Code and a violation occurs, the compensation is includible in income when it is no longer subject to a substantial risk of forfeiture and the holder may be subject to a 20% penalty tax and, in some cases, interest penalties. The Amended 2018 Plan and awards granted thereunder are intended to be exempt from or conform to the requirements of Section 409A of the Code.

ELANCO ANIMAL HEALTH INCORPORATED – Proxy Statement | 50 |

Proxy Item No. 4

Section 162(m). Section 162(m) of the Code denies deductions to publicly held corporations for compensation paid to certain senior executives that exceeds $1,000,000.

Withholding. Elanco is entitled to satisfy all applicable income and employment taxes required by federal, state, municipal or foreign law to be withheld by deducting from the payment or settlement of any award (whether made in shares or cash), withholding from wages or other cash compensation payable to the participant, or requiring the participant to pay such withholding taxes to Elanco as a condition of receiving payment or settlement of an award.

New Plan Benefits. Awards under the Amended 2018 Plan will be granted in amounts and to individuals as determined by the Compensation Committee in its sole discretion. Therefore, the benefits or amounts will be received by employees, officers, or directors under the Amended 2018 Plan are not determinable at this time.

Existing Plan Benefits. In accordance with SEC rules, the following table lists all stock options granted to the individuals and groups indicated below since the adoption of the Amended 2018 Plan through March 15, 2021. The option awards listed below for the covered executives include the stock options listed in the executive compensation tables beginning on page 34 of this Proxy Statement and are not additional awards.

Name and Position

| Number of Stock Options

Granted |

Jeffrey Simmons | 109,642 |

Todd Young | - |

Aaron Schacht | 21,086 |

Sarena Lin | 21,086 |

Michael-Bryant Hicks | 29,383 |

Current executive officers as a Group | 244,455 |

Non-Executive directors as a group | - |

All other employees (including all current officers who are not executive officers) as a group | 176,842 |

Recommendation of the Board

The Board unanimously recommends a vote FOR the approval of the Amended and Restated 2018 Elanco Stock Plan.

|

ELANCO ANIMAL HEALTH INCORPORATED – Proxy Statement | 51 |

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table summarizes information as of December 31, 2020, relating to our equity compensation plans under which equity securities are authorized for issuance:

| | Number of securities to

be issued upon

exercise of outstanding

options and rights | Weighted-average

exercise price of

outstanding options

and rights | Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

column (a)) |

| Plan Category | (a) | (b) | (c) |

| Equity Compensation Plans approved by security holders | 4,340,815(1) | $31.61(2) | 5,587,100 |

| Equity Compensation Plans not approved by security holders | - | - | - |

| Total | 4,340,815 | $31.61 | 5,587,100 |